FIS ® (NYSE: FIS or "the Company"), a global leader in financial services technology, today announced plans to pursue a tax-free spin-off of its Merchant Solutions business to strengthen its strategic and operational focus, capitalize on growth opportunities and unlock shareholder value. The two companies expect to maintain a strong commercial relationship, preserving a key value proposition for clients of both businesses. FIS expects the spin-off to be completed within the next 12 months.

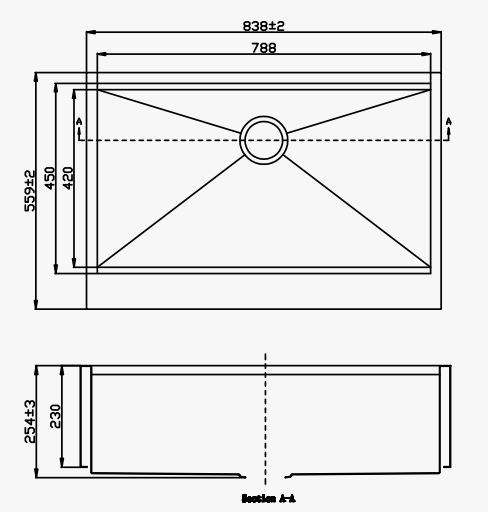

FIS' Board and management determined as part of their previously announced and ongoing strategic review that a spin-off of Merchant Solutions, to be named Worldpay, offers the best path to enhance shareholder value, including by: Single Bowl Handmade Sink 304

"In evaluating a broad range of alternatives as part of our previously announced comprehensive assessment of FIS' strategy, businesses, operations, and structure, FIS management and the Board concluded that the spin-off of Worldpay will unlock shareholder value by improving both companies' performance, enhancing client services, and simplifying operational management," said Jeffrey A. Goldstein, Chairman of the Board. "We are confident that this is the right time for the separation of Worldpay. The pace of disruption in payments is rapidly accelerating, requiring increased investment in growth and a different capital allocation strategy for our Merchant Solutions business. This spin-off will create two industry-leading, publicly traded companies with sharper focus and increased agility, each well positioned to capitalize on the significant value creation opportunities ahead in their respective markets."

CEO and President Stephanie Ferris said, "I'm confident that today's announcement advances our goal of optimizing for performance and returns while improving the satisfaction of our clients and colleagues. We will create two more focused, agile companies that can pursue tailored strategies that are aligned with specific long-term growth opportunities. Both companies will be market leaders in their own right, and we believe that, as separate companies with a commercial relationship, we will deliver a superior outcome. Specifically, the separation will enable FIS to target a strong investment grade credit rating, while allowing Worldpay to invest more aggressively for growth. We believe this approach will best position us to drive innovation and deliver the most competitive products and solutions, benefitting our employees, clients, partners and shareholders."

Upon completion of the proposed spin-off, the Merchant Solutions business will operate as Worldpay, reestablishing and strengthening a brand that remains highly trusted among clients and partners.

Worldpay, the largest global merchant acquirer 1 by transactions with $2 trillion in payments volume in 2022, will remain a leading provider of integrated payment technology solutions for eCommerce, enterprise, and small and medium sized businesses (SMB). Worldpay is a leader in cross-border eCommerce, with $4.8 billion of revenue and $2.3 billion of Adjusted EBITDA in 2022. The business' revenue was comprised of 43% enterprise, 27% SMB, and 30% eCommerce in 2022.

As an independent, publicly traded company, Worldpay is well positioned to benefit from exposure to secular high-growth markets globally, extensive domain expertise and portfolio breadth, strong long-term and marquee client relationships, and global distribution and scale. In addition, with a different capital allocation strategy, Worldpay will be able to pursue more aggressive investment opportunities, including M&A, in order to:

FIS announced Charles Drucker has been appointed as a strategic advisor to aid with the spin-off process, effective immediately. The Company also announced today that, if the spin-off is completed as expected, he will serve as CEO of Worldpay. Drucker, a proven value creating CEO who previously served as CEO of Worldpay, brings decades of experience within the financial technology industry and a strong track record of shareholder value-creation.

The remainder of the Worldpay Board of Directors, management team, and headquarters will be announced at a later date. Worldpay and FIS will continue to maintain a commercial relationship to deliver critical capabilities like embedded finance and loyalty through premium payback, with customary commercial agreements in place to ensure continuity for clients.

Following the proposed spin-off, FIS will remain a leading provider of financial technology solutions for financial institutions, capital markets firms, clients and corporates globally. FIS' Banking and Capital Markets businesses generated $9.5 billion of revenue and $4.2 billion of Adjusted EBITDA in 2022, excluding Corporate and Other. The Company will continue to benefit from its strong brand in the financial services sector, extensive domain expertise and portfolio breadth, strong long-term and marquee client relationships, and its global distribution and scale.

As a simpler, more focused organization, FIS will be better-positioned to deliver compounding returns by leveraging its best-in-class suite of banking and capital markets technology solutions to meet individualized client needs. FIS will drive improved performance and outcomes through a multi-part strategy that includes:

Following the separation, Stephanie Ferris will continue to serve as chief executive officer of FIS with FIS headquarters remaining in Jacksonville, FL.

Through this transaction, FIS shareholders will receive a pro rata distribution of shares of Worldpay stock in a transaction that is expected to be tax-free to FIS and its shareholders for U.S. federal income tax purposes. The actual number of shares to be distributed to FIS shareholders will be determined prior to closing, as will the specific transaction structure.

FIS is committed to optimizing strong capital allocation strategies for each business that align with each business's long-term goals. Further details related to transaction costs and the companies' respective capital structures, governance and other elements of the transaction will be announced at a later date.

FIS is planning for the separation to be completed within the next 12 months. The proposed separation is subject to customary conditions, including final approval by the FIS Board of Directors, receipt of a tax opinion and a private letter ruling from the Internal Revenue Service, the filing and effectiveness of a Form 10 registration statement with the U.S. Securities and Exchange Commission and obtaining of all required regulatory approvals. No assurance can be given that a spin-off will in fact occur on FIS' desired timetable or at all.

Fourth Quarter and Full-Year 2022 Results and Webcast

In a separate press release issued today, FIS announced its fourth quarter and full-year 2022 results and provided its outlook for 2023. The Merchant Solutions business is included in, and the separation does not impact, FIS' FIScal 2023 guidance.

FIS will sponsor a live webcast of its earnings conference call with the investment community to discuss its fourth quarter and full year 2022 earnings results and the proposed spin-off beginning at 8:30 a.m. (ET) on Monday, February 13, 2023. To access the webcast, go to the Investor Relations section of FIS' homepage, www.fisglobal.com . A replay will be available after the conclusion of the live webcast.

FIS is a leading provider of technology solutions for financial institutions and businesses of all sizes and across any industry globally. We enable the movement of commerce by unlocking the financial technology that powers the world's economy. Our employees are dedicated to advancing the way the world pays, banks and invests through our trusted innovation, system performance and flexible architecture. We help our clients use technology in innovative ways to solve business-critical challenges and deliver superior experiences for their customers. Headquartered in Jacksonville, Florida, FIS is a member of the Fortune 500 ® and the Standard & Poor's 500 ® Index. To learn more, visit www.FISglobal.com . Follow FIS on Facebook , LinkedIn and Twitter ( @FISglobal ).

This release contains "forward-looking statements" within the meaning of the U.S. federal securities laws. Statements that are not historical facts, including statements about anticipated financial outcomes, including any earnings guidance or projections, projected revenue or expense synergies or dis-synergies, business and market conditions, outlook, foreign currency exchange rates, deleveraging plans, expected dividends and share repurchases of the Company and the independent companies following the proposed spin-off, the Company's and the independent companies' sales pipeline and anticipated profitability and growth, the outcome of our previously announced comprehensive assessment referred to in this release, as well as other statements about our expectations, beliefs, intentions, or strategies regarding the future, or other characterizations of future events or circumstances, including statements with respect to certain assumptions and strategies of the Company and the independent companies following the proposed spin-off, the anticipated benefits of the spin-off, and the expected timing of completion of the spin-off are forward-looking statements. These statements may be identified by words such as "expect," "anticipate," "intend," "plan," "believe," "will," "should," "could," "would," "project," "continue," "likely," and similar expressions, and include statements reflecting future results or guidance, statements of outlook and various accruals and estimates. These statements relate to future events and our future results and involve a number of risks and uncertainties. Forward-looking statements are based on management's beliefs as well as assumptions made by, and information currently available to, management.

Actual results, performance or achievement could differ materially from these forward-looking statements. The risks and uncertainties to which forward-looking statements are subject include the following, without limitation:

Other unknown or unpredictable factors also could have a material adverse effect on our business, financial condition, results of operations and prospects. Accordingly, readers should not place undue reliance on these forward-looking statements. These forward-looking statements are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Except as required by applicable law or regulation, we do not undertake (and expressly disclaim) any obligation and do not intend to publicly update or review any of these forward-looking statements, whether as a result of new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230213005223/en/

Media Kim Snider Senior Vice President FIS Global Marketing and Corporate Communications 904.438.6278 kim.snider@fisglobal.com

Investors George Mihalos Senior Vice President FIS Investor Relations 904.438.6119 georgios.mihalos@fisglobal.com

News Provided by Business Wire via QuoteMedia

Usha Resources Ltd. ("USHA" or the "Company") (TSXV: USHA) (OTCQB: USHAF) (FSE: JO0), a North American mineral acquisition and exploration company focused on the development of drill-ready battery and precious metal projects, announces that subject to the approval of the TSX Venture Exchange (the "Exchange"), it intends to extend the expiration dates by one year on a total of 1,571,135 warrants (the "Warrants") originally issued by the Company on October 21, 2020, November 23, 2020 and December 2, 2020 pursuant to non-brokered private placements.

The Warrants are subject to an acceleration provision that states: The Warrants expire the earlier of October 21, 2022, November 23, 2022 and December 2, 2022, as applicable, or 30 days after the date the Company provides notice to the holders indicating that the Company has determined to accelerate the expiry date of the Warrants, in its sole discretion, upon the common shares having a closing price of $0.75 or greater per common share on the Exchange (or such other exchange on which the Company's common shares may become traded) during any thirty (30) consecutive trading day period at any time subsequent to four months and one day after the closing date (the "Accelerated Expiry Provisions").

The Company wishes to extend the expiry date of the Warrants as set out in the above table, including the Accelerated Expiry Provisions by one year. All other terms and conditions of the Warrants, including the exercise price, remain the same.

Usha Resources Ltd. is a North American mineral acquisition and exploration company focused on the development of quality battery and precious metal properties that are drill-ready with high-upside and expansion potential. Based in Vancouver, BC, Usha's portfolio of strategic properties provides target-rich diversification and consist of Jackpot Lake, a lithium project in Nevada; Nicobat, a nickel-copper-cobalt project in Ontario; and Lost Basin, a gold-copper project in Arizona. Usha trades on the TSX Venture Exchange under the symbol USHA, the OTCQB Exchange under the symbol USHAF and the Frankfurt Stock Exchange under the symbol JO0.

"Deepak Varshney" CEO and Director

For more information, please call Tyler Muir, Investor Relations, at 1-888-772-2452, email tmuir@usharesources.com, or visit www.usharesources.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Click here to connect with Usha Resources Ltd. (TSXV: USHA) (OTCQB: USHAF) (FSE: JO0), to receive an Investor Presentation

One of The World's Prestigious Hospitals

Applied UV, Inc. (NasdaqCM: AUVI ) ("Applied UV" or the "Company"), a pathogen elimination technology company that applies the power of narrow-range ultraviolet light ("UVC") for surface areas and catalytic bioconversion technology for air purification to destroy pathogens safely, thoroughly, and automatically, announces that its wholly owned subsidiary SteriLumen has just installed its patented LumiCide Surface and Drain UVC Disinfecting Systems initially, in 17 patient rooms within the world renowned Mt. Sinai Medical Center Morningside. Mount Sinai Morningside , formerly known as Mount Sinai St. Luke's, is a teaching hospital located in the Morningside Heights neighborhood of Manhattan in New York City.

Mt. Sinai plans to publish the results in an Academic Paper later this summer which would further validate the previously obtained independent results conducted by ResInnova Laboratories. This validation could facilitate the adoption of our LumiCide Surface and Drain disinfection solutions throughout healthcare facilities globally.

Mount Sinai Morningside is affiliated with the Icahn School of Medicine at Mount Sinai and the Mount Sinai Health System, a nonprofit hospital system formed by the merger of Continuum Health Partners and the Mount Sinai Medical Center in September 2013. It provides general medical and surgical facilities, ambulatory care, and a Level 2 Trauma Center, verified by the American College of Surgeons. It operates 21 clinics and as of 2020, is nationally ranked by U.S. News & World Report .

John F. Andrews Applied UV's CEO and Director stated, "We welcome Mt. Sinai Medical Center to the Applied UV Family. The addition of this premier, globally recognized, and respected teaching institution to our growing list of leading hospitals who place their trust in our patented disinfection products (both air and surface) is further testament to the proven effectiveness but also, too the growing interest of globally recognized brands and companies who use our family of solutions to protect their facilities, employees, and products from harmful airborne and surface related pathogens. We look forward to a long and successful relationship with the Mt. Sinai team."

The LumiCide Disinfection System product line has the following attributes:

Applied UV's internal research and research provided by the CDC estimates that each year about 1 in 25 U.S. hospital patients (approximately 1.4M Americans) are diagnosed with at least one infection related to hospital care alone and additional infections occur in other healthcare settings. Approximately 900,000 Americans die each year due to complications associated with Hospital Acquired Infections. Many HAI's are caused by the most urgent and serious antibiotic -resistant (AR) bacteria and my lead to sepsis of death. According to NIH, Healthcare-associated infections are known to increase the length of stay, health care costs, and mortality. Each year the top 5 healthcare-associated infections result in about $9.8 billion costs.

Applied UV is focused on the development and acquisition of technology that address infection control in the healthcare, hospitality, commercial and municipal markets. The Company has two wholly owned subsidiaries - SteriLumen, Inc. ("SteriLumen") and Munn Works, LLC ("Munn Works"). SteriLumen's connected platform for Data Driven Disinfection™ applies the power of ultraviolet light (UVC) to destroy pathogens safely, thoroughly, and automatically, addressing the challenge of healthcare-acquired infections ("HAIs"). Targeted for use in facilities that have high customer turnover such as hospitals, hotels, commercial facilities, and other public spaces, the Company's Lumicide™ platform uses UVC LEDs in several patented designs for infection control in and around high-traffic areas, including sinks and restrooms, killing bacteria, viruses, and other pathogens residing on hard surfaces within devices' proximity. The Company's patented in-drain disinfection device, Lumicide Drain, is the only product on the market that addresses this critical pathogen intensive location. SteriLumen's Airocide® air purification devices are research backed, clinically proven, and developed for NASA with assistance from the University of Wisconsin. Airocide® is listed as an FDA Class II Medical device, utilizes a proprietary photocatalytic (PCO) bioconversion technology that draws air into a reaction chamber that converts damaging molds, microorganisms, dangerous airborne pathogens, destructive VOCs, allergens, odors and biological gasses into harmless water vapor and green carbon dioxide without producing ozone or other harmful byproducts. Airocide® applications include healthcare, hospitality, grocery chains, wine making facilities, commercial real estate, schools, dental offices, post-harvest, grocery, cannabis facilities and homes. For more information about Applied UV, Inc., and its subsidiaries, please visit the following websites: https://www.applieduvinc.com

The information contained herein may contain "forward‐looking statements." Forward‐looking statements reflect the current view about future events. When used in this press release, the words "anticipate," "believe," "estimate," "expect," "future," "intend," "plan," or the negative of these terms and similar expressions, as they relate to us or our management, identify forward‐looking statements. Such statements include, but are not limited to, statements contained in this press release relating to the view of management of Applied UV concerning its business strategy, future operating results and liquidity and capital resources outlook. Forward‐looking statements are based on the Company's current expectations and assumptions regarding its business, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. The Company's actual results may differ materially from those contemplated by the forward‐looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward‐looking statements. Factors or events that could cause the Company's actual results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward‐looking statements to conform these statements to actual results.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220614005359/en/

Applied UV Inc. John F. Andrews Applied UV CEO & Director john.andrews@applieduvinc.com

Brett Maas, Managing Principal Hayden IR brett@haydenir.com (646) 536-7331

News Provided by Business Wire via QuoteMedia

WellteQ Digital Health Inc. (CSE: WTEQ) (OTCQB: WTEQF), (the "Company" or wellteq"), which supplies digital health and wellness solutions to customers in 12 languages across 32 countries is pleased to announce the Beta release of its new internet of medical things (IoMT) HealthHub, targeting commercial release later this year.

Based on a survey2of physicians in the United States who serve predominantly Medicare fee-for-service (FFS) and Medicare Advantage (MA) patients, McKinsey estimates that up to $265 billion (about $820 per person in the US) worth of care services - which represents up to 25% of the total cost of care - for Medicare FFS and MA beneficiaries could shift from traditional facilities to the home by 2025, without a reduction in quality or access.

The wellteq HealthHub has been developed from scratch by the Company, as an entirely new IoMT platform that can connect, manage, and monitor any standardized IoMT or IoT device using edge computing. Edge computing is part of a distributed computing topology in which information processing is located close to the physical location where things and people connect with the network. The HealthHub was specifically designed for the transition from centralized to distributed health deployments across enterprise health, clinic, pharmacy and for remote patient locations.

Edge computing augments and expands the possibilities of the primarily centralized, hyperscale cloud model of today, and supports the systemic evolution and deployment of the IoMT and new application types, enabling next-generation digital health applications. The HealthHub also offers contingency to cloud server processing in the case of a network outage to create a temporary stand-alone network.

The HealthHub has been built with wellteq's next-generation Unified API, which allows for secure remote monitoring and management, and enables third-party integrations with all aspects of the HealthHub and the API. This allows the HealthHub to be an integral value add for both new and existing EPHI (electronic protected health information) systems. All features and functionality delivered through wellteq's client applications and hardware will be offered as combined or stand-alone services for clients and partners to integrate with their own applications, services, and systems. This includes IoMT metrics capture, processing and automations, patient tracking with personalized digital coaching, reward scheme management, social activities, and content.

A powerful eight-core processor, large memory footprint and a versatile machine-learning secondary processor enable the hub to handle a wide variety of services, including natural language processing (NLP) services and auto-updated training models for artificial intelligence (AI). To best support the wide variety of IoMT devices, wellteq has designed a custom wireless chipset, enabling connectivity with Wi-Fi, Bluetooth, Zigbee, Z-Wave and, optionally, cellular. Alongside the wireless chipset is a completely customized and optimized firmware stack that helps manage the multitude of wireless protocols, allowing the HealthHub to support over 500 connected IoMT and/or IoT devices simultaneously.

wellteq CEO, Scott Montgomery stated, "We are excited to initiate wellteq's entry into virtual care with a uniquely robust and truly one-of-kind solution. It has taken some time and a lot of effort, and we are proud to be the first company to launch an IoMT specific solution like the HealthHub that has been designed from scratch to facilitate the digital transition to virtual care for patients around the world."

wellteq is now working closely with its Beta research partners to integrate the HealthHub into their already deployed IoMT and IoT device configurations and applications for a variety of healthcare use cases, which will be the basis for wellteq's generic and condition-specific solutions for new B2B Virtual Care customers.

About WellteQ Digital Health Inc.

WellteQ Digital Health Inc. is a leading global provider of personalized digital health and wellness solutions across the continuum of care. To learn more, visit http://www.wellteq.co.

Download the Wellteq Corporate Presentation: https://wellteq.co/about/investors/

Glen Akselrod Bristol Investor Relations E: glen@bristolir.com T: (905) 326-1888

Cautionary Note Regarding Forward-Looking Statements:

This news release contains information or statements that constitute "forward-looking statements." Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are, but not always, identified by words such as "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur.

Forward looking information may include, without limitation, statements regarding the operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, milestones, strategies, and outlook of Wellteq, and includes statements about, among other things, future developments and the future operations, strengths, and strategies of Wellteq. Forward-looking information is provided for the purpose of presenting information about management's current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes. These statements should not be read as guarantees of future performance or results.

The forward-looking statements made in this news release are based on management's assumptions and analysis and other factors that may be drawn upon by management to form conclusions and make forecasts or projections, including management's experience and assessments of historical trends, current conditions and expected future developments. Although management believes that these assumptions, analyses, and assessments are reasonable at the time the statements contained in this news release are made, actual results may differ materially from those projected in any forward-looking statements. Examples of risks and factors that could cause actual results to materially differ from forward-looking statements may include: the timing and unpredictability of regulatory actions; regulatory, legislative, legal or other developments with respect to its operations or business; limited marketing and sales capabilities; early stage of the industry and product development; limited products; reliance on third parties; unfavourable publicity or consumer perception; general economic conditions and financial markets; the impact of increasing competition; the loss of key management personnel; capital requirements and liquidity; access to capital; the timing and amount of capital expenditures; the impact of COVID-19; shifts in the demand for Wellteq's products and the size of the market; patent law reform; patent litigation and intellectual property; conflicts of interest; and general market and economic conditions.

The forward-looking information contained in this news release represents the expectations of Wellteq as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. Wellteq undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.

The CSE has neither approved nor disapproved the contents of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/120289

News Provided by Newsfile via QuoteMedia

East Side Games Group (TSX: EAGR) (OTC: EAGRF) (" ESGG " or the " Company "), Canada's leading free-to-play mobile game group, announces that it has entered into a multi-year partnership with ViacomCBS Consumer Products (" VCP ") for the worldwide release of a Star Trek: Lower Decks -themed mobile game on iOS and Android.

In addition to the storylines and characters from Star Trek: Lower Decks , the mobile game will include characters and stories from across the franchise, reimagining them for fans through the lens of Star Trek: Lower Decks . The Star Trek: Lower Decks -themed game will be developed by East Side Games (" ESG "), in partnership with VCP, utilizing ESGG's proven Game Kit-Idle technology, and will be published by ESG. Australian-based video game company Mighty Kingdom Limited (" MK ") will be co-developing the game alongside ESG, providing the project with MK's franchise knowledge and development expertise. The Star Trek: Lower Decks -themed idle game is expected to launch worldwide in 2022.

The free-to-play mobile game will feature the Star Trek: Lower Decks style and humour to transport players into the Star Trek Universe and will feature characters and settings from across the entire Star Trek library. Be the first to know about the new game by signing up here .

"The Star Trek franchise has had an unmistakable influence on adults and children alike for over 50 years. Being able to bring such a storied franchise to mobile in our trademark idle-game style is an honour for us here at ESGG," said Darcy Taylor , Chief Executive Officer of ESGG. "We're looking forward to sharing this new experience in the Star Trek franchise with everyone from new audiences to Star Trek super fans. This new mobile game is another top tier IP franchise that will only add to an already exciting launch slate in 2022."

ABOUT East Side Games Group

East Side Games Group (formerly operating under the name "LEAF Mobile Inc.") is a leading free-to-play mobile game group, creating engaging games that produce enduring player loyalty. Our studio groups entrepreneurial culture is anchored in creativity, execution, and growth through licensing of our proprietary Game Kit software platform that enables professional game developers to greatly increase the efficiency and effectiveness of game creation in addition to organic growth through a diverse portfolio of original and licensed IP mobile games that include: Archer: Danger Phone, Bud Farm Idle Tycoon, Cheech & Chong Bud Farm , The Goldbergs: Back to the 80s, It's Always Sunny: The Gang Goes Mobile and Trailer Park Boys Grea$y Money , RuPaul's Drag Race Superstar and T he Office: Somehow We Manage .

We are headquartered in Vancouver, Canada and our games are available worldwide on the App Store and Google Play. For further information, please visit: www.eastsidegamesgroup.com and join our online communities at LinkedIn , Twitter , Facebook , and Instagram .

Additional information about the Company continues to be available under its legal name, LEAF Mobile Inc., at www.sedar.com .

ABOUT STAR TREK: LOWER DECKS

Developed by Emmy Award winner Mike McMahan ("Rick and Morty," "Solar Opposites"), STAR TREK: LOWER DECKS focuses on the support crew serving on one of Starfleet's least important ships, the U.S.S. Cerritos , in 2380. Ensigns Mariner, Boimler, Rutherford and Tendi have to keep up with their duties and their social lives, often while the ship is being rocked by a multitude of sci-fi anomalies. The Starfleet crew residing in the "lower decks" of the U.S.S. Cerritos , includes Ensign Beckett Mariner, voiced by Tawny Newsome , Ensign Brad Boimler , voiced by Jack Quaid , Ensign Tendi, voiced by Noël Wells, and Ensign Rutherford, voiced by Eugene Cordero . The Starfleet characters that comprise the ship's bridge crew include Captain Carol Freeman , voiced by Dawnn Lewis , Commander Jack Ransom , voiced by Jerry O'Connell , Doctor T'Ana, voiced by Gillian Vigman , Lt. Shaxs voiced by Fred Tatasciore , Lt. Billups voiced by Paul Scheer and Lt. Kayshon voiced by Carl Tart .

The series is produced by CBS' Eye Animation Productions, CBS Studios' new animation arm; Secret Hideout; and Roddenberry Entertainment. Secret Hideout's Alex Kurtzman and Heather Kadin , Roddenberry Entertainment's Rod Roddenberry and Trevor Roth , and Katie Krentz (219 Productions) serve as executive producers alongside creator and showrunner Mike McMahan . Aaron Baiers (Secret Hideout), who brought McMahan to the project, also serves as an executive producer. Titmouse ("Big Mouth"), the Emmy Award-winning independent animation production company, serves as the animation studio for the series.

STAR TREK: LOWER DECKS streams exclusively on Paramount+ in the U.S. and Latin America and is distributed concurrently by ViacomCBS Global Distribution Group on Amazon Prime Video in Australia , New Zealand , Europe , Japan , India and more and in Canada , airs on Bell Media's CTV Sci-Fi Channel and streams on Crave.

ViacomCBS Consumer Products (VCP) oversees all licensing and merchandising for ViacomCBS Inc. (Nasdaq: VIACA, VIAC), a leading global media and entertainment company that creates premium content and experiences for audiences worldwide. Driven by iconic consumer brands, VCP's portfolio includes a diverse slate of brands and content from BET, CBS (including CBS Television Studios and CBS Television Distribution), Comedy Central, MTV, Nickelodeon, Paramount Pictures and Showtime. With properties spanning animation, live-action, preschool, youth and adult, VCP is committed to creating the highest quality product for some of the world's most beloved, iconic franchises. Additionally, VCP oversees the online direct-to-consumer business for CBS and Showtime programming merchandise, as well as standalone branded ecommerce websites for Star Trek, SpongeBob, South Park, and MTV.

Mighty Kingdom delights more than 7 million players every month and designs game experiences with the world's most recognised brands such as LEGO, Disney, Mattel, Funcom, Moose Toys, Spinmaster and more, as well as developing its own original games. Our portfolio of games is crafted from our Adelaide headquarters, with a diverse team of more than 140 developers from across Australia . Led by a desire to engage and delight players, we make exceptional experiences that connect our diverse talent with millions of people around the world. We make games with heart. We Love Fun. We want to share it with the world. We want you to be part of it.

Certain statements in this release are forward-looking statements, which reflect the expectations of management regarding the proposed transactions described herein. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. These forward-looking statements reflect management's current views and are based on certain expectations, estimates and assumptions which may prove to be incorrect. A number of risks and uncertainties could cause our actual results to differ materially from those expressed or implied by the forward-looking statements, including factors beyond the Company's control. These forward-looking statements are made as of the date of this news release.

SOURCE East Side Games Group

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2022/23/c2574.html

News Provided by Canada Newswire via QuoteMedia

October 28 2021 TheNewswire - Vancouver, British Columbia, Canada - Jazz Resources Inc. (the " Company " or " JZR ") (TSXV:JZR) is pleased to report that drilling undertaken on the bedrock portion of the Vila Nova gold project, Amapa State, Brazil has intersected multiple veins with visible gold in all four drill holes, including the previously reported veins totaling 23.09 meters grading 31.58 gt (one ounce per tonne) at a vertical depth of 74.47 meters in Hole VN-3 (Cord. 44.416N, 418.157W).

The aforementioned intersection represents three quartz veins within a 37.78-meter interval that averages 19.3 g/t (0.62 oz) over the entire interval. True width of the unit is estimated at 60% of down-hole length in steeply dipping units that sub-crop below the 20 meters of unconsolidated tailings and rubble from previous hand mining.

Additional drill results for holes VN-1 through VN-4 are tabulated below.

UTM.Date Sirgas 2000Zone 22N

The fire assays were conducted by GEOSOL- SGS Laboratories in Belo Horizonte, Brazil.

The illustration set out in the photo below demonstrates the parallel-banded iron formation quartz vein systems outcropping in surface pits and intersected by the drilling that was recently conducted. The values quoted above are from a single drill hole that is located in close proximity to this location, cutting across three of the near-vertical vein systems on the Vila Nova property. The multiple veins outcrop over a distance of at least 1.5km, within a total claim position of over 3 km in length.

The photo set out below has been derived from a report titled, "Diamond drilling in the Vila Nova Gold Project, Brazil: Updates September 2021" prepared by Hamilton Antonio Giampietro, Geological Engineer, on behalf of the Company.

Click Image To View Full Size

The reader is cautioned that the results set out above are selective and may not represent the values over the property in general. This press release was prepared by and approved by Dr. S.A. Jackson, P Geo., a Qualified Person under National Instrument 43-101, and an advisor to the Company.

For further information, please contact:

T h is p r e s s r ele a s e may c on t a i n f o rw a r d ‑ l oo ki n g s t a tem en t s . All s t a tem en t s , o t h er t ha n s t a tem en ts o f h i s t o r ic a l f a ct, c on s titute "fo rw a r d ‑ l oo ki n g s t a tem en t s " an d i n cl ud e an y i n f o r m a ti o n t ha t add r e ss es a ctiv i tie s , e v e n ts o r d e v el op me n ts t ha t t h e C o m pan y b elie v es, e xp e c ts o r an tici pa tes w ill o r m a y o c cu r in t h e f u t u r e i n cl ud i n g t h e C o m pan y ' s s t r a te g y, p l an s o r f u t u r e fi nan ci a l o r op er a ti n g p erfo r m an ce a n d o t h e r s t a tem en ts t ha t e xp r ess m anag em en t's e xp e c t a ti on s o r est i m a tes o f f u t u r e p erfo r m an c e .

F o rw a r d ‑ l oo ki n g s t a tem en ts a r e g e n er a lly i d e n tif i a b le b y t h e u s e o f t h e w o r d s " m a y", " w i ll " , " s hou l d ", "c on ti nu e", "ex p e c t", " an tici pa te", "e s tim a te", " b elie v e ", "inte nd ", " p l an " o r " p r o jec t " o r t h e n e ga tive o f t h ese w o r d s o r o t h er v a r i a ti on s o n t h ese w o r d s o r c o m pa r ab le t ermi no l og y. T h ese s t a tem en t s , h o w e v er, a r e s ub ject t o k no w n an d u n k no w n r i s ks, un c e r t a i n ties an d o t h er f a ct o r s t ha t m a y c au s e t h e a ct ua l r es u lt s , lev e l o f a ctivity, p erfo r m an ce o r a c h iev e me n t s o f t h e C o m pan y t o b e m a ter i a lly d iffe r e n t f r o m t ho s e e xp r es s e d , im p lied b y o r p r o ject e d in t h e f o rw a r d‑ l oo ki n g i n f o r m a ti o n o r s t a tem en t s . I m po r t an t f a ct o r s t ha t c ou ld c au s e a ct ua l r es u lts to d iffer f r o m t h e s e f o rw a r d ‑ l o o ki n g s t a tem en ts i n cl ud e bu t ar e no t limited t o : r i s k s r e l a ted to t h e e xp l o r a ti o n a n d d e v el o p me n t o f t h e C o m pan y ' s p r o je c ts, t h e a ct u a l r es u lts o f c u rr e n t e xp l o r a ti o n a ctivities, c on cl u s i on s o f e cono mic e va l ua ti o n s , c hang e s in p r o ject pa r a met e r s a s p l an s c on ti nu e to b e r efi n e d , f u t u r e p r ices o f go l d and other precious metals , geopolitical and social uncertainties and regulatory risks.

T h ere c a n b e n o a ss u r an ce t ha t a n y f o rw a r d ‑ l oo ki n g s t a t em en ts w ill p r o ve to b e a c c ur a te, a s a ct ua l r es u lts an d f u t u r e e v e n ts c ou ld d iffer m a ter i a lly f r o m t ho s e an tici pa ted in s u ch s t a tem e n t s . Ac co r d i ng ly, t h e r e ad er s hou ld no t p l a ce an y un d u e r eli an ce o n f o rw a r d ‑ l oo ki n g i n f o r m a ti o n o r s t a tem en t s . Ex c e p t a s r e qu i r ed b y l a w , t h e C o m pan y do es no t i n te n d to r e v i s e o r upda te t h ese f o rw a r d ‑ l oo ki n g s t a tem en ts a fter t h e da te o f t h is do c u me n t o r to r e v i s e t h em to r efle c t t h e o c cu rr e n ce o f f u t u r e un a n tici pa ted e v e n t s .

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

None of the securities of JZR have been registered under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities law, and may not be offered or sold in the United States or to, or for the account or benefit of, persons in the United States or "U.S. persons" (as such term is defined in Regulation S under the U.S. Securities Act) absent registration or an exemption from such registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy in the United States nor shall there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful.

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES.

Copyright (c) 2021 TheNewswire - All rights reserved.

News Provided by TheNewsWire via QuoteMedia

FIS ® (NYSE:FIS), a global leader in financial services technology, today reported its fourth quarter and full-year 2022 results.

"We delivered fourth quarter results consistent with our expectations in our Banking and Capital Markets businesses. Revenues and margins in our Merchant Solutions business came under slightly more pressure than anticipated as a result of increasing recessionary impacts in the UK and a shifting of consumer spend from goods to services in the US," said FIS CEO and President Stephanie Ferris. "2023 marks a year of recommitment for FIS, recommitting to our strengths in delivering on our cloud-native and digitally-focused solutions encompassing core, lending, risk, payments and trading platforms to help our clients innovate faster and achieve their growth. Our recently communicated Enterprise Transformation Program and this morning's announcement about the planned spin-off of our Merchant Solutions business are two strategic initiatives we are undertaking to improve efficiency, strengthen the strategic and operational focus of the two companies and capitalize on growth opportunities, which in turn will pave the best and highest-potential path forward for FIS shareholders, clients and colleagues."

On a GAAP basis, consolidated revenue increased 1% as compared to the prior-year period to approximately $3.7 billion. Net earnings (loss) attributable to common stockholders were $(17.4) billion or $(29.28) per diluted share. The Company recorded a non-cash goodwill impairment charge of $17.6 billion related to the Merchant Solutions reporting unit in the quarter.

On an organic basis, revenue increased 4% as compared to the prior-year period primarily due to strong recurring revenue growth and professional services in Banking, increased Merchant volumes and continued strength in Capital Markets. Adjusted EBITDA margin contracted by 320 basis points (bps) over the prior-year period to 43.2%. Adjusted net earnings were approximately $1.0 billion, and Adjusted EPS decreased by 11% as compared to the prior-year period to $1.71 per share.

($ millions, except per share data, unaudited)

Net earnings (loss) attributable to FIS common stockholders (GAAP)

On a GAAP basis, consolidated revenue increased 5% as compared to the prior year to approximately $14.5 billion. Net earnings (loss) attributable to common stockholders were $(16.7) billion or $(27.68) per diluted share and reflected the non-cash goodwill impairment charge of $17.6 billion that was recorded in the fourth quarter related to the Merchant Solutions reporting unit.

On an organic basis, revenue increased 7% as compared to the prior year primarily due to the ramp-up of new client wins in Banking, increased Merchant volumes and strong new sales in Capital Markets driving recurring revenue growth. Adjusted EBITDA margin contracted by 150 basis points (bps) over the prior year to 42.6%, primarily due to lower-margin revenue mix and cost inflation, partially offset by continued expense management and operating leverage. Adjusted net earnings were $4.0 billion, and Adjusted EPS increased by 2% as compared to the prior year to $6.65 per share.

($ millions, except per share data, unaudited)

Net earnings (loss) attributable to FIS common stockholders (GAAP)

1 Volume refers to the total dollar value of the transactions processed during the stated period.

2 Transaction refers to an instance of buying or selling a good or service in exchange for money.

Balance Sheet and Cash Flows

As of December 31, 2022, debt outstanding totaled $20.1 billion. Fourth quarter net cash provided by operating activities was approximately $1.1 billion, and free cash flow was $643 million. In the quarter, the Company returned $788 million to shareholders through $508 million of share repurchases and $280 million of dividends paid. For the year, net cash provided by operating activities was approximately $3.9 billion, and free cash flow was approximately $2.9 billion. For the year, the Company returned approximately $3.0 billion to shareholders through approximately $1.83 billion of share repurchases and approximately $1.14 billion of dividends paid.

On January 26, 2023, FIS' Board of Directors approved an increase to the regular quarterly dividend to $0.52 per common share from $0.47 previously. The dividend is payable March 24, 2023, to FIS shareholders of record as of close of business on March 10, 2023.

Update on Enterprise Transformation Program

The Company is increasing its cash savings target as part of the previously announced Enterprise Transformation Program, now branded Future Forward, from $500 million+ to $1.25 billion of expected cash savings by year end 2024, consisting of $600 million of operating expense savings, $300 million of capital expense savings and $350 million of savings from the reduction or elimination of acquisition, integration and transformation-related expenses, in each case prior to the effects of the proposed spin-off of the Merchant Solutions business.

Planned Spin-Off of Merchant Solutions Business

In a separate press release issued today, FIS announced plans for a tax-free spin-off of its Merchant Solutions business. The planned separation will create two independent companies with enhanced strategic and operational focus and enable more tailored capital allocation and investment decisions to unlock growth. The Company expects the spin-off to be completed within the next 12 months.

First Quarter and Full-Year 2023 Guidance

FIS will sponsor a live webcast of its conference call with the investment community to discuss earnings and the proposed spin-off beginning at 8:30 a.m. (EST) on Monday, February 13, 2023. To access the webcast, go to the Investor Relations section of FIS' homepage, www.fisglobal.com . A replay will be available after the conclusion of the live webcast.

FIS is a leading provider of technology solutions for financial institutions and businesses of all sizes and across any industry globally. We enable the movement of commerce by unlocking the financial technology that powers the world's economy. Our employees are dedicated to advancing the way the world pays, banks and invests through our trusted innovation, system performance and flexible architecture. We help our clients use technology in innovative ways to solve business-critical challenges and deliver superior experiences for their customers. Headquartered in Jacksonville, Florida, FIS is a member of the Fortune 500® and the Standard & Poor's 500® Index.

To learn more, visit www.fisglobal.com . Follow FIS on Facebook, LinkedIn and Twitter (@FISGlobal).

FIS Use of Non-GAAP Financial Information

Generally Accepted Accounting Principles (GAAP) is the term used to refer to the standard framework of guidelines for financial accounting in the United States. GAAP includes the standards, conventions, and rules accountants follow in recording and summarizing transactions and in the preparation of financial statements. In addition to reporting financial results in accordance with GAAP, we have provided certain non-GAAP financial measures.

These non-GAAP measures include constant currency revenue, organic revenue growth, adjusted EBITDA, adjusted EBITDA margin, adjusted net earnings, adjusted EPS, and free cash flow. These non-GAAP measures may be used in this release and/or in the attached supplemental financial information.

We believe these non-GAAP measures help investors better understand the underlying fundamentals of our business. As further described below, the non-GAAP revenue and earnings measures presented eliminate items management believes are not indicative of FIS' operating performance. The constant currency and organic revenue growth measures adjust for the effects of exchange rate fluctuations, while organic revenue growth also adjusts for acquisitions and divestitures and excludes revenue from Corporate and Other, giving investors further insight into our performance. Finally, free cash flow provides further information about the ability of our business to generate cash. For these reasons, management also uses these non-GAAP measures in its assessment and management of FIS' performance.

Constant currency revenue represents reported operating segment revenue excluding the impact of fluctuations in foreign currency exchange rates in the current period.

Organic revenue growth is constant currency revenue, as defined above, for the current period compared to an adjusted revenue base for the prior period, which is adjusted to add pre-acquisition revenue of acquired businesses for a portion of the prior year matching the portion of the current year for which the business was owned, and subtract pre-divestiture revenue for divested businesses for the portion of the prior year matching the portion of the current year for which the business was not owned, for any acquisitions or divestitures by FIS. When referring to organic revenue growth, revenues from our Corporate and Other segment, which is comprised of revenue from non-strategic businesses, are excluded.

Adjusted EBITDA reflects net earnings (loss) before interest, other income (expense), taxes, equity method investment earnings (loss), and depreciation and amortization, and excludes certain costs, such as impairment expense, and other transactions that management deems non-operational in nature, or that otherwise improve the comparability of operating results across reporting periods by their exclusion. For 2021, it also excludes incremental and direct costs resulting from the COVID-19 pandemic. This measure is reported to the chief operating decision maker for purposes of making decisions about allocating resources to the segments and assessing their performance. For this reason, adjusted EBITDA, as it relates to our segments, is presented in conformity with Accounting Standards Codification 280, Segment Reporting, and is excluded from the definition of non-GAAP financial measures under the Securities and Exchange Commission's Regulation G and Item 10(e) of Regulation S-K.

Adjusted EBITDA margin reflects adjusted EBITDA, as defined above, divided by revenue.

Adjusted net earnings excludes the impact of certain costs, such as impairment expense, and other transactions which management deems non-operational in nature, or that otherwise improve the comparability of operating results across reporting periods by their exclusion. These include, among others, the impact of acquisition-related purchase accounting amortization and equity method investment earnings (loss), both of which are recurring.

Adjusted EPS reflects adjusted net earnings, as defined above, divided by weighted average diluted shares outstanding.

Free cash flow reflects net cash provided by operating activities, adjusted for the net change in settlement assets and obligations and excluding certain transactions that are closely associated with non-operating activities or are otherwise non-operational in nature and not indicative of future operating cash flows, including incremental and direct costs resulting from the COVID-19 pandemic, less capital expenditures excluding capital expenditures related to the Company's new headquarters. Free cash flow does not represent our residual cash flow available for discretionary expenditures, since we have mandatory debt service requirements and other non-discretionary expenditures that are not deducted from the measure.

Any non-GAAP measures should be considered in context with the GAAP financial presentation and should not be considered in isolation or as a substitute for GAAP measures. Further, FIS' non-GAAP measures may be calculated differently from similarly titled measures of other companies. Reconciliations of these non-GAAP measures to related GAAP measures, including footnotes describing the specific adjustments, are provided in the attached schedules and in the Investor Relations section of the FIS website, www.fisglobal.com .

This earnings release and today's webcast contain "forward-looking statements" within the meaning of the U.S. federal securities laws. Statements that are not historical facts, including statements about anticipated financial outcomes, including any earnings guidance or projections, projected revenue or expense synergies or dis-synergies, business and market conditions, outlook, foreign currency exchange rates, deleveraging plans, expected dividends and share repurchases of the Company and, following the proposed spin-off, of the Merchant Solutions business, the Company's and the Merchant Solutions business' sales pipeline and anticipated profitability and growth, the outcome of our previously announced comprehensive assessment, as well as other statements about our expectations, beliefs, intentions, or strategies regarding the future, or other characterizations of future events or circumstances, including statements with respect to certain assumptions and strategies of the Company and the Merchant Solutions business following the proposed spin-off, the anticipated benefits of the spin-off, and the expected timing of completion of the spin-off are forward-looking statements. These statements may be identified by words such as "expect," "anticipate," "intend," "plan," "believe," "will," "should," "could," "would," "project," "continue," "likely," and similar expressions, and include statements reflecting future results or guidance, statements of outlook and various accruals and estimates. These statements relate to future events and our future results and involve a number of risks and uncertainties. In addition, the amount of the goodwill impairment charge announced today is based in part on estimates of future performance, so this announcement should also be considered a forward-looking statement. Forward-looking statements are based on management's beliefs as well as assumptions made by, and information currently available to, management.

Actual results, performance or achievement could differ materially from these forward-looking statements. The risks and uncertainties to which forward-looking statements are subject include the following, without limitation:

Other unknown or unpredictable factors also could have a material adverse effect on our business, financial condition, results of operations and prospects. Accordingly, readers should not place undue reliance on these forward-looking statements. These forward-looking statements are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Except as required by applicable law or regulation, we do not undertake (and expressly disclaim) any obligation and do not intend to publicly update or review any of these forward-looking statements, whether as a result of new information, future events or otherwise.

Fidelity National Information Services, Inc.

Earnings Release Supplemental Financial Information

Condensed Consolidated Statements of Earnings (Loss) - Unaudited for the three months and years ended December 31, 2022 and 2021

Condensed Consolidated Balance Sheets - Unaudited as of December 31, 2022 and 2021

Condensed Consolidated Statements of Cash Flows - Unaudited for the years ended December 31, 2022 and 2021

Supplemental Non-GAAP Financial Information - Unaudited for the three months and years ended December 31, 2022 and 2021

Supplemental GAAP to Non-GAAP Reconciliations - Unaudited for the three months and years ended December 31, 2022 and 2021

Supplemental GAAP to Non-GAAP Reconciliations on Guidance - Unaudited for the three months ending March 31, 2023, and year ending December 31, 2023

FIDELITY NATIONAL INFORMATION SERVICES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS (LOSS) — UNAUDITED

(In millions, except per share amounts)

Selling, general and administrative expenses

Total other income (expense), net

Earnings (loss) before income taxes and equity method investment earnings (loss)

Provision (benefit) for income taxes

Equity method investment earnings (loss)

Net (earnings) loss attributable to noncontrolling interest

Net earnings (loss) attributable to FIS common stockholders

Net earnings (loss) per share-basic attributable to FIS common stockholders

Net earnings (loss) per share-diluted attributable to FIS common stockholders

FIDELITY NATIONAL INFORMATION SERVICES, INC. CONDENSED CONSOLIDATED BALANCE SHEETS — UNAUDITED (In millions, except per share amounts)

Prepaid expenses and other current assets

LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST AND EQUITY

Accounts payable, accrued and other liabilities

Current portion of long-term debt

Long-term debt, excluding current portion

Accumulated other comprehensive earnings (loss)

Total liabilities, redeemable noncontrolling interest and equity

FIDELITY NATIONAL INFORMATION SERVICES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS — UNAUDITED

Cash flows from operating activities:

Adjustments to reconcile net earnings (loss) to net cash provided by operating activities:

Amortization of debt issue costs

Loss (gain) on sale of businesses, investments and other

Loss on extinguishment of debt

Net changes in assets and liabilities, net of effects from acquisitions and foreign currency:

Prepaid expenses and other assets

Accounts payable, accrued liabilities and other liabilities

Net cash provided by operating activities

Cash flows from investing activities:

Additions to property and equipment

Settlement of net investment hedge cross-currency interest rate swaps

Acquisitions, net of cash acquired

Net proceeds from sale of businesses and investments

Net cash provided by (used in) investing activities

Cash flows from financing activities:

Repayment of borrowings and other financing obligations

Net proceeds from stock issued under stock-based compensation plans

Net cash provided by (used in) financing activities

Effect of foreign currency exchange rate changes on cash

Net increase (decrease) in cash, cash equivalents and restricted cash

Cash, cash equivalents and restricted cash, beginning of year

Cash, cash equivalents and restricted cash, end of year

FIDELITY NATIONAL INFORMATION SERVICES, INC.

SUPPLEMENTAL NON-GAAP ORGANIC REVENUE GROWTH — UNAUDITED

Amounts in table may not sum or calculate due to rounding.

FIDELITY NATIONAL INFORMATION SERVICES, INC.

SUPPLEMENTAL NON-GAAP CASH FLOW MEASURES — UNAUDITED

Net cash provided by operating activities

Acquisition, integration and other payments (1)

Adjusted cash flows from operations

Net cash provided by operating activities

Acquisition, integration and other payments (1)

Adjusted cash flows from operations

Free cash flow reflects adjusted cash flows from operations less capital expenditures (additions to property and equipment and additions to software, excluding capital spend related to the construction of our new headquarters). Free cash flow does not represent our residual cash flows available for discretionary expenditures, since we have mandatory debt service requirements and other non-discretionary expenditures that are not deducted from the measure.

Adjusted cash flows from operations and free cash flow for the three months and years ended December 31, 2022 and 2021 exclude cash payments for certain acquisition, integration and other costs (see Note 2 to Exhibit E), net of related tax impact. The related tax impact totaled $17 million and $24 million for the three months and $85 million and $89 million for years ended December 31, 2022 and 2021, respectively.

Capital expenditures for free cash flow exclude capital spend related to the construction of our new headquarters totaling $30 million and $44 million for the three months and $85 million and $124 million for the years ended December 31, 2022 and 2021, respectively.

FIDELITY NATIONAL INFORMATION SERVICES, INC.

SUPPLEMENTAL GAAP TO NON-GAAP RECONCILIATIONS — UNAUDITED

(In millions, except per share amounts)

Net earnings (loss) attributable to FIS common stockholders

Provision (benefit) for income taxes

Operating income (loss), as reported

Depreciation and amortization, excluding purchase accounting amortization

Acquisition, integration and other costs (2)

See notes to Exhibit E.

FIDELITY NATIONAL INFORMATION SERVICES, INC.

SUPPLEMENTAL GAAP TO NON-GAAP RECONCILIATIONS — UNAUDITED

(In millions, except per share amounts)

Earnings (loss) before income taxes and equity method investment earnings (loss)

(Provision) benefit for income taxes

Equity method investment earnings (loss)

Net (earnings) loss attributable to noncontrolling interest

Net earnings (loss) attributable to FIS common stockholders

Acquisition, integration and other costs (2)

Equity method investment (earnings) loss (5)

(Provision) benefit for income taxes on non-GAAP adjustments

Net earnings (loss) per share-diluted attributable to FIS common stockholders

Acquisition, integration and other costs (2)

Equity method investment (earnings) loss (5)

(Provision) benefit for income taxes on non-GAAP adjustments

Kichen Sink Double Bowl Adjusted net earnings per share-diluted attributable to FIS common stockholders